A New Era of Uncertainties, AI boom and bust, The halt in Fed Fund Rate (Weekly Report from Jan 27 - Feb 2)

This post is served with the purpose of bringing some useful information about the global economy

1. Uncertainties coming from a cavalcade of executive orders

Donald Trump has officially inaugurated on January 20th with the witnesses and praises from thousands of attendants in which some are well-known billionaires such as Elon Musk from Tesla and SpaceX, Jeff Bezos from Amazon, Mark Zuckerberg from Meta, and others from big corporations, gathering to celebrate for the new term of the US which is called “ The Golden Age” by the new president.

During his inaugural speech, there are several issues addressed with given solutions , in a vigorous manner of speaking, such as:

He begun with the declare that “The Golden Age of America begins right now”, signaling the changes in his policies will ameliorate the sovereignty, safety, and prosperity of the US citizens.

After that, he mentioned the failure of the assassination happened previously due to God saving him for a purpose. Then, he vowed to "make America great again" by addressing issues such as immigration, national security, and economic growth, and claimed that his recent election is a mandate for significant change.

At the end, he expressed his intentions by using all of the power to deter these challenges in order to raise better living standard of domestic individuals.

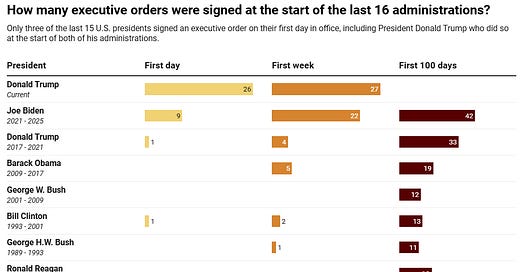

At the same day, Donald Trump has signed 26 *executive orders, which are more than any former presidents on Day 1.

*An executive order is an order issued unilaterally by the president who carries the force of law. Presidents use executive orders to execute their campaign promises or policy goals that may face opposition or roadblocks in Congress.

There are some significant executive orders Trump signed including:

Ending birthright citizenship, meaning that if you are born in America but your identical parents have not gotten the citizenship identification yet, you are not recognized as an US individual. (There are many states showing disagreements on this controversial action)

Withdrawing from the World Health Organization - Trump said that the amount of money putting in the organization was higher than any others but the welfare received is unbalanced.

Categorizing human sexes in only male or female

Restoring freedom of speech and ending federal censorship

Restoring death penalty

Found an External Revenue Service to collect tariffs and duties from foreign trade for debt paying strategy, and to suspend US participation in the Global Tax Deal

Threaten to impose 25% tariff on the 2 allies Canada and Mexico starting on Feb 2.

Execute the immigration deportation programme of some specific areas such as Colombia

2. $500bn Investment on AI Infrastructure

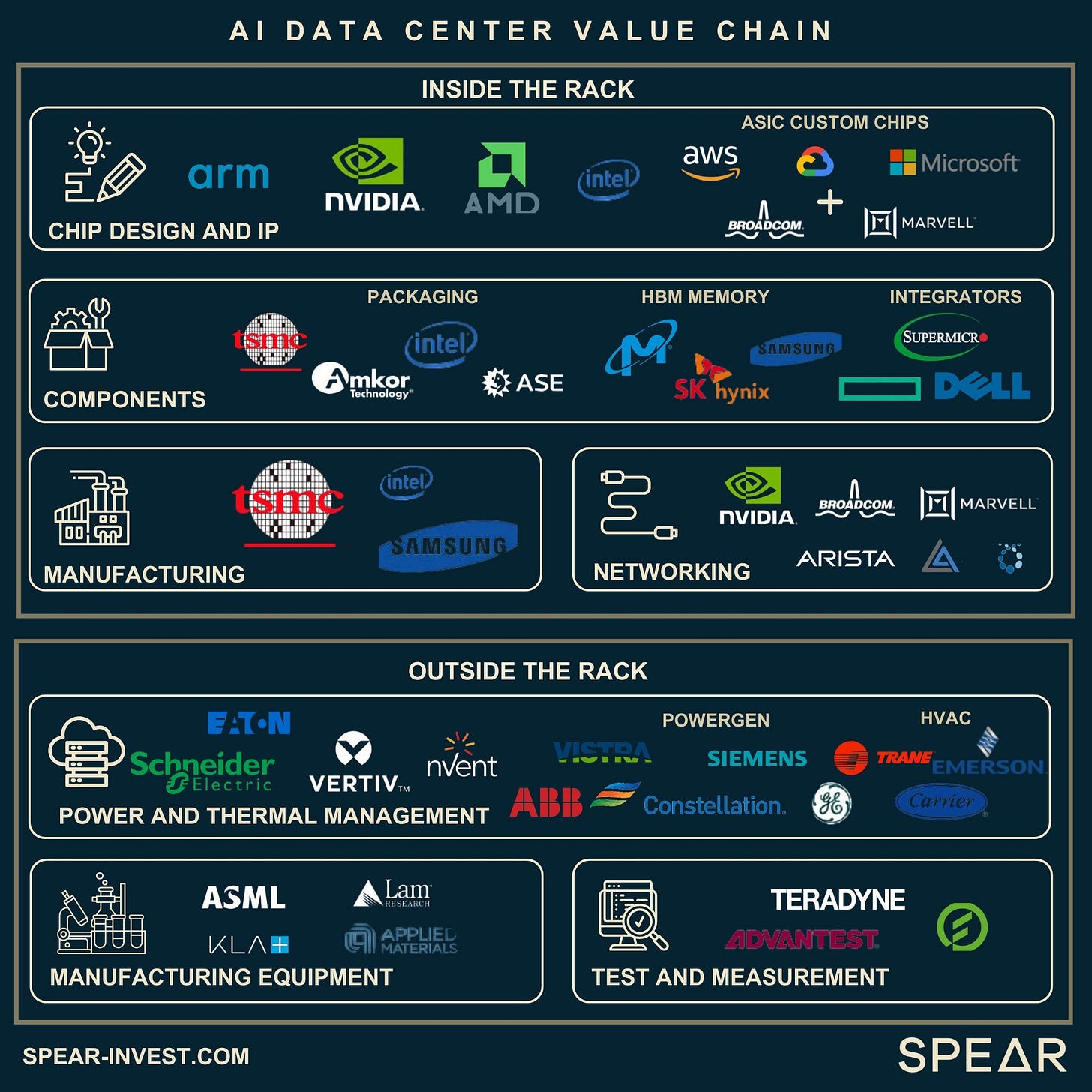

The new president has just announced a new AI company called “Stargate”, worth $500 billion and being in charge by OpenAI-CEO Sam Altman, SoftBank-CEO Masayoshi Son and Oracle-Chairman Larry Ellison. The aim of the company is to focus on the development of the biggest and best artificial intelligence infrastructure located in the US with the availability to be accessible vastly by users all over the country and can also open huge job vacancies for people. However, reaching this sky requires massive amounts of infrastructure, power, computer chips and data centers, equaling to gigantic investments. This can only happen if multiple companies and investors are able to work cooperatively.

*The Chain of AI Data Center

However, the pronouncement of the project also received skepticisms, interestingly coming from Elon Musk when he criticized the investment would not be adequate due to lack of money, which immediately lower the hype and excitement of the project from individuals.

3. DeepSeek sparkled concerns about AI optimization

After the vigorous utterance of the new-elect president related to the new “Stargate” project, AI-related stocks specifically and the US market generally were thrown cold water on by the rise of an AI model called DeepSeek. The reason behind its glory is that it is able to utilize cheaper chips after the policy to limit chips exportation to China, yet remaining the efficiency and accuracy to be in line with top AI-models such as Claude, Gemini (Google) or Open AI.

In this year, it is to be anticipated that the spending for AI Infrastructure will continuously grow to $274.2 bn, a rise of 22% compared to the previous year. This raised concerned for the investors due to the belief that sophisticated chips will generate stupendous models, but currently there is proof proving that normal chips can create ones too.

The new president, Donald Trump, said publicly that this was a wakeup call for the AI industry. As a result, AI-related stocks witnessed a significant drop, leading by Nvidia when nearly $600 bn in valuation has disappeared, setting new record for the biggest lost in a day for Nvidia.

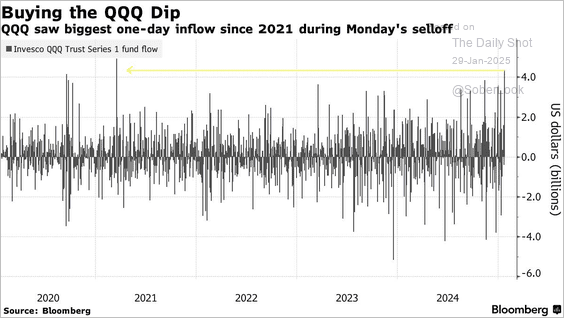

The consequence shows the underlying risk of high valuations. When having fancy for perfection or near completion, a stock is extremely susceptible to drawback news whether it is lack of details or in-depth analysis, which could easily trigger a flutter of sell-off. Despite of the fueled rout of tech stocks on Monday, couple days ahead illustrated large inflows of buying, signaling the re-enter of investors.

4. Fed remained interest rate flat, as widely expected

The Federal Reserve seems not to be in the urge of rate cutting after a demand of “immediate rate cut” from the president Donald Trump last week. Powell has decided to leave the rate unchanged at the range of 4.25% and 4.5%, firmly believing that macroeconomic factors are relatively strong.

However, with the incoming policies from the new president related to immigration deportation, universal tariffs, and deregulations, pressures surely exists and are on the Fed’ shoulders as they will have to put a dozen of efforts to deal with upcoming uncertainties so as to maintain their ultimate goals, 2% inflation and lower unemployment rate.

5. UK stocks surprisingly outperformed US market this week

This week gave information about the massive sell-off of AI-related stocks, affecting the US market in general, while the FTSE 100, the United Kingdom's best-known stock market index of the 100 most highly capitalised blue chips listed on the London Stock Exchange, escalated cumulatively to over 8,600 from the latest bottom of 8,200.

6. Gold climbed to a new record amid policy uncertainties

25% tariffs on goods for Canada and Mexico announced to have an immediate effect on February 2nd 2025 raised frustration and confusion among related parties, showing the uncertainties of what these nations are likely to do to retaliate the US. Consequently, Gold rapidly rose and reached its peak, at 2,800.

7. Canada announces 25% tariffs imposed on the US goods

To offset the loss, Canada’s PM Trudeau have stated to retaliate against the US president Donald Trump’s policy of putting forward 25% tariffs on Canada goods by imposing the same proportion on American products from beverages to appliances, worth C$155 billion ($107 billion). Those on C$30 billion will take effect on Tuesday, the same day as Trump's tariffs, and duties on the remaining C$125 billion in 21 days.

* Canada's Prime Minister Justin Trudeau is joined by Finance Minister Dominic LeBlanc, Minister of Foreign Affairs Melanie Joly, and Minister of Public Safety David McGuinty, as he speaks during a press conference while responding to U.S. President Donald Trump's orders to impose 25% tariffs on Canadian imports, in Ottawa, Ontario, Canada February 1, 2025.

Both businesses located in these two nations are driven up the wall and possess butterflies around as they have no clue to make up strategies due to the rapid escalation of uncertainties amid the beginning of trade wars.

Mikey Research is a place where I collect and rewrite the economic news. It helps me understand better the perspectives from all around the world and is the way to practice my writing skill, so it’s totally free. If you like my cozy spot, share it to your friend :)