A widening gap between the US and other countries (Weekly Report from Jan 13-19)

This post is served with the purpose of bringing some useful information about the global economy

As the bond yields are relatively high due to the vigorous labor market and stable economy, the global stock indexes are suffering a gradual drop with Asia is leading. While the increase in expectations that rate cut will not occur has negatively impact the whole markets, some experts believe this results in current expensive US stocks with the P/E of S&P 5000 trading at 28.7, and the adjustment are necessary and healthy when the fragility and susceptibility is extremely high related to the news

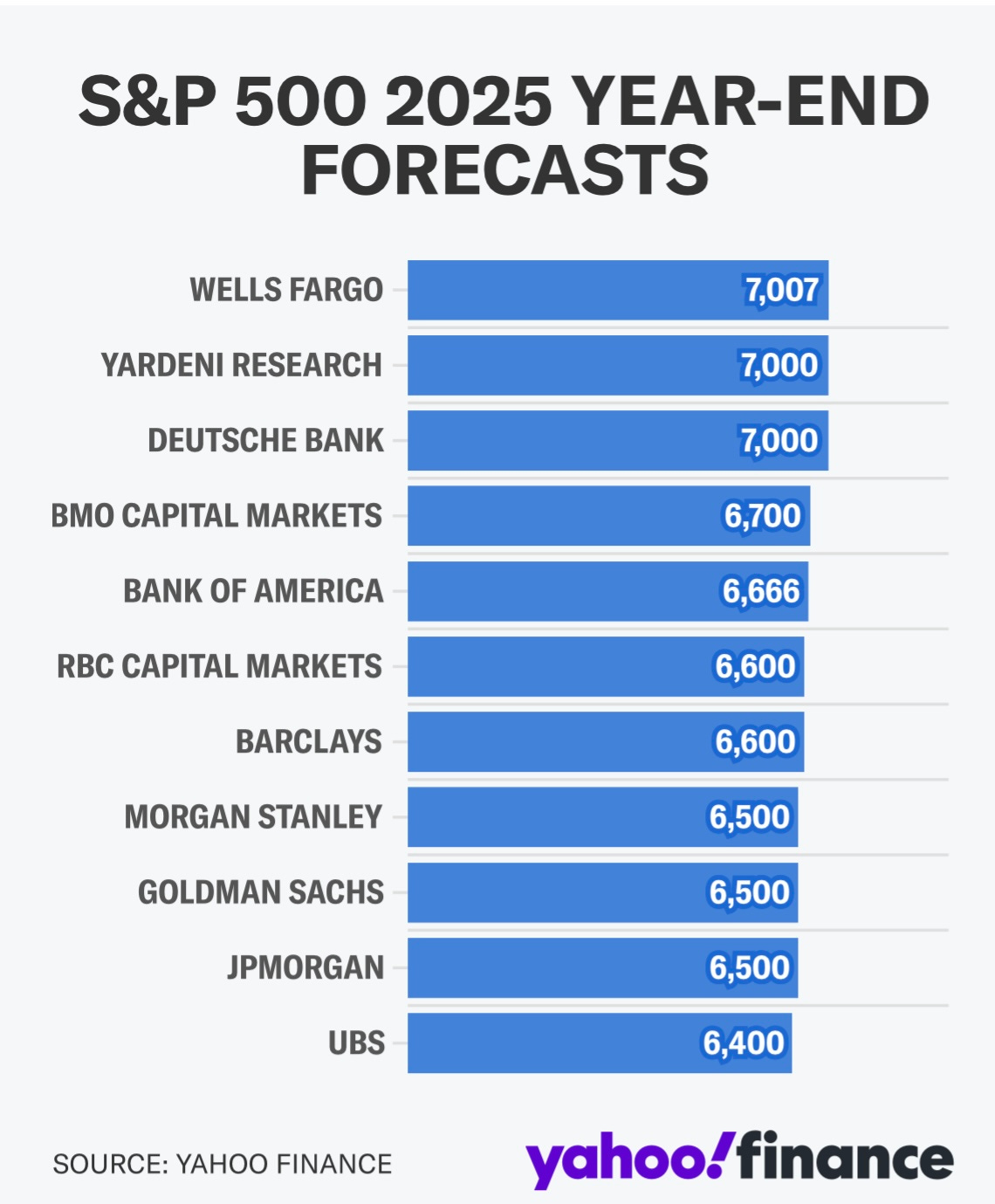

However, the overall is to be anticipated as remaining attractive to invest into America based on the durability of the economy and the strong performance of enterprises, especially Information Technology. Some institutions already predicted the achievement of 7000 of S&P 500 at the end of 2025.

On the other hand, Asia markets are not compatible with the nation above, they have endured vast outflows from investors owing to the shift into more attractive assets such as US technology stocks and Cryptocurrency. In addition, Asian nations illustrates the weaker pictures with businesses and economies getting in various issues

China: This is a prime example which there are many problems existing at once in this nation including:

Household Crisis: With the default of multiple “big real estate” corporations like Evergrande or Country Garden, many related industries such as construction, materials, and home furnishings have been in troubles for years, resulting in the delays of many uncompleted buildings and the homebuyers are stuck paying mortgages on those properties, leading to social unrest and mortgage boycotts.

Low Consumer Spending: Record levels of unemployment among young people (over 20%) are a major concern, combined with the deflationary of prices making people reduce their purchasing power and future prospects.

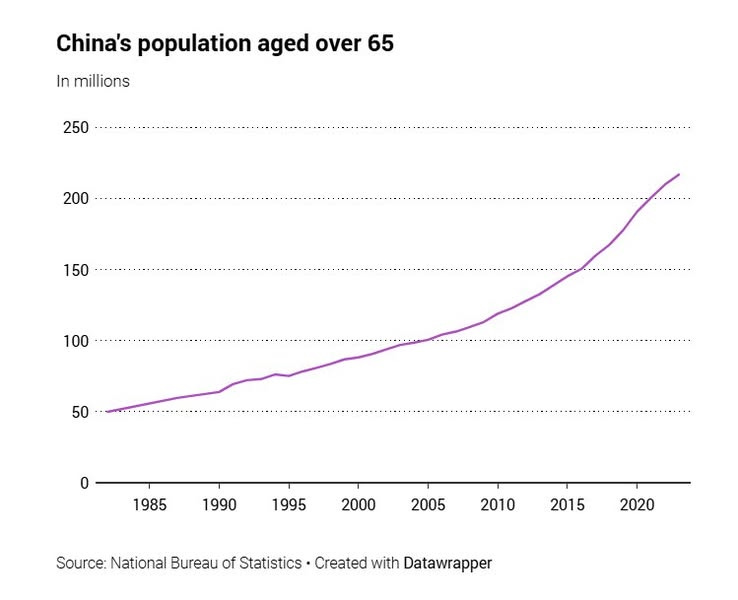

Demographic Challenges: Chinese workforces for the first time in decades show weaknesses due to the shrink in population, putting more pressure on the productivity of businesses and the national growth. In addition to the difficulty, with the rapid rise of aging population, there will be an increase of costs in healthcare, potentially putting insurance companies on the verge of bankruptcy and damages the real economy

Geopolitical Tension: Trade war with the US seems to be inevitable when the incoming administration have pledges to impose 60% tariffs on goods from China, increasing pressure on those internal businesses.

Korea: Chaos still occurs in this nation when Korean president have just been announced to be arrested for proposing the material law in short periods, rising uncertainties as far as political roles are concerned and resulting in the continuous weakness of Won compared to US Dollars.

Not only in China and Korea but all around Asian countries also align themselves with struggles, and Vietnam is one of them which has already mentioned in my last post.

Extra visualization of the current gap in Earnings between America and the World, illustrating a spacious difference of the US’s uptick and the global markets’ downfall.

Other macroeconomic news

1. Sticky Inflations allows the Fed to remain high interest rate

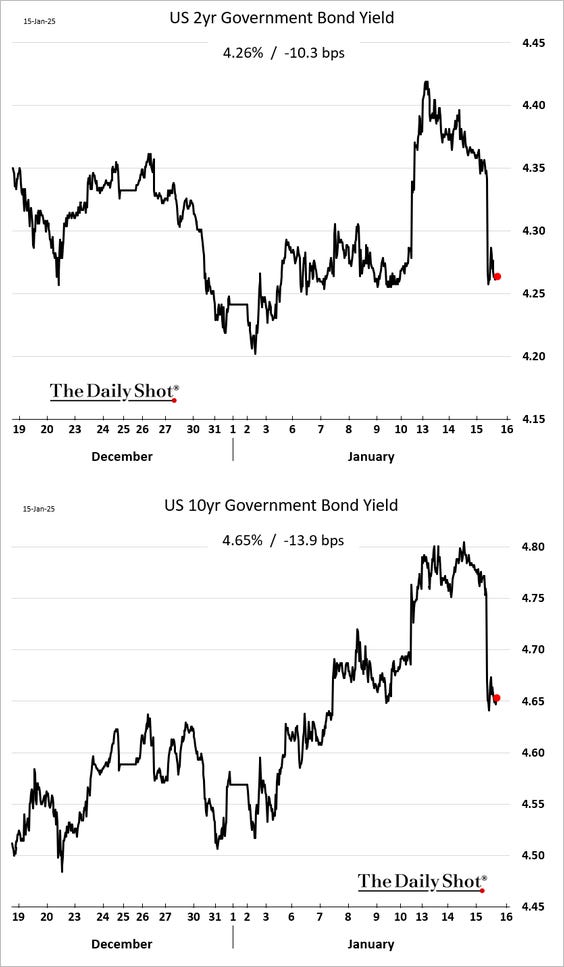

The Consumer Price Index (CPI) number was in line with many expectations with 2.9% year-over-year, up from 2.7%, signaling more uncertainties related to the probability of inflation uptick in upcoming months. However, core CPI, predicted to remain unchanged with the previous month, witnessed a slight drop by 0.1% to 0.2%, showing major inflationary factors are cooling down.

It is to be expected that the Fed will pause its rate cut in the incoming meeting based on the strong and resilient economy of the US. In addition, markets over the world reacted positively with the CPI readings.

The Stoxx Europe 600 rose 0.8% as of 8:08 a.m. London time

S&P 500 futures rose 0.4%

Nasdaq 100 futures rose 0.6%

Futures on the Dow Jones Industrial Average rose 0.2%

The MSCI Asia Pacific Index rose 1%

The MSCI Emerging Markets Index rose 1.2%

Bitcoin was little changed at $99,753.48

2. Bond yields dropped significantly after cooling-than-expected CPI readings

3. The UK GDP continues its disappointment

The UK's economy grew by 0.1% in November, below forecasts of 0.2% growth. In fact, the economy has now grown just twice in the five months since Labour took office, and will stagnate for a second straight quarter unless GDP grows by more than 0.07% in December. Services, the largest sector in the UK economy, grew by just 0.1% in November, while construction output rebounded by 0.4%.

4. Germany GDP showed 2 yearly consecutive negative figures, signaling weaknesses in the real economy with various difficulties

5. Banks in the US saw exceptional profits in their earnings

A surge in Banking Corporations’ profits informed a resilient and vigorous economy among America with 2 main revenues rising significantly (Net Interest Income (NII) and Noninterest Income)

* Net Interest Income (NII): The difference between interest earned on loans (like mortgages) and interest paid to depositors (like savings accounts). It’s the primary source of income for many banks and depends on interest rates.

* Noninterest Income: The revenue from services unrelated to interest. It includes fees (like ATM charges), advisory services, and trading revenue. Banks relying more on noninterest income are less affected by interest rate changes.

Mikey Research is a place where I collect and rewrite the economic news. It helps me understand better the perspectives from all around the world and is the way to practice my writing skill, so it’s totally free. If you like my cozy spot, share it to your friend :)