Investors' Nervousnesses (Weekly Summary)

This post is served with the purpose of bringing some useful information about the global economy

1. Uncertainties rising amid multiple policies from the new administration

Week after week, we have heard a flutter of news related to tariffs from president Trump executed in upcoming months, from an additional 10% tariff on all imported Chinese goods, a broader 25% tariff on imports of steel and aluminum, his intention to impose reciprocal tariffs on countries that tax imports from the U.S to the intentional tariffs on European car imports at the start of April. Additionally, he also pledged to impose additional tariffs on the exports of any country imposing retaliatory tariffs on America.

This leads to the frustration to many businesses related to considerable imports or exports and investors as they are currently sitting on their hands due to the vague implications of those policies. However, one thing many experts anticipated is the negative impact on the overall economy such as GDP slowdown, higher inflation, and national debt uptick.

2. Grok3 added more heat in the AI race

This week marked the introduction of Grok3 family including Grok3 and Grok3 mini (reasoning and non-reasoning models), owned by xAI, an American startup company working in the area of artificial intelligence founded by Elon Musk. The model has three modes: Think, Big Brain, and DeepSearch, which enable it to spend more processing power at inference to get better results. What makes it special is that the family outperformed other significant AI models such as Gemini (Google), Deepseek, and OpenAI in math (AIME 2024), science (GPQA), and coding (LiveCodeBench) despite the fact that the model is less than 2 years old.

Additionally, Grok3 also ranked first in Chatbot Arena, an open platform for crowdsourced AI benchmarking voted by over 1,000,000 users. The model currently stands at the top in all categories such as Overall w/ Style Control, Hard Prompts & Hard Prompt w/ Style Control, Coding, Math, Creative Writing, Instruction Following, Longer Query and Multi-Turn.

To date, Grok 3 is available to all users on X for the short-term period. In a long run, it is to be expected that it will be utilized by the subscribers to X’s Premium+ ($40 monthly for users in the United States; the price varies by country) and will be part of a new subscription service called SuperGrok.

3. The biggest lost in 2025 from the US stock markets amid tariff concerns

The U.S. stock market's worst day of 2025, with a $927 billion wipeout, was driven by concerns over inflation and President Donald Trump's proposed tariffs. The Dow Jones Industrial Average dropped approximately 800 points, and the S&P 500 saw significant declines by 1.7%. Economic data showing consumer prices rising at the fastest monthly pace since August 2023, with an annual inflation rate of 3%, added to market unease.

Trump's recent announcements of new tariffs, including a 10% levy on Chinese imports and 25% tariffs on autos, semiconductors, and pharmaceuticals, heightened fears of stagflation—a mix of sluggish growth and persistent inflation.

Worries about Trump's hard-line trade policies, including reciprocal tariffs on countries taxing U.S. imports, stoked fears of trade wars, reducing investor confidence.

*Interesting charts

Gen Z specifically and all the age groups generally witnessed a drop in interacting with friend per minute daily due to the rise of technology occurring in the 2010s. With the proliferation of internet area through multiple frequent-used apps such as Facebook, Tiktok, or Youtube, people nowadays tend to spend most of their leisure time entertaining with online activities by scrolling the news, videos and pictures, and not being preferable to any types of social interaction with their friends or family. This graph can be seen as a wake up call despite dozen of benefits brought by technologies, emphasizing the balance between hybrid and face-to-face actions.

Japanese CPI continuously escalated in the latest reading with Food Sector keeps getting expensive, reaching almost 8%. This shows the resilience of inflation among nations around the world and triggers other methodologies needed to deal with this stickiness.

99% FDI flowing out of China in the past 3 years due to ominous concerns related to an economic slowdown, aging era, and extreme anti-spying policy for foreign corporations, triggering the massive movement to other nations.

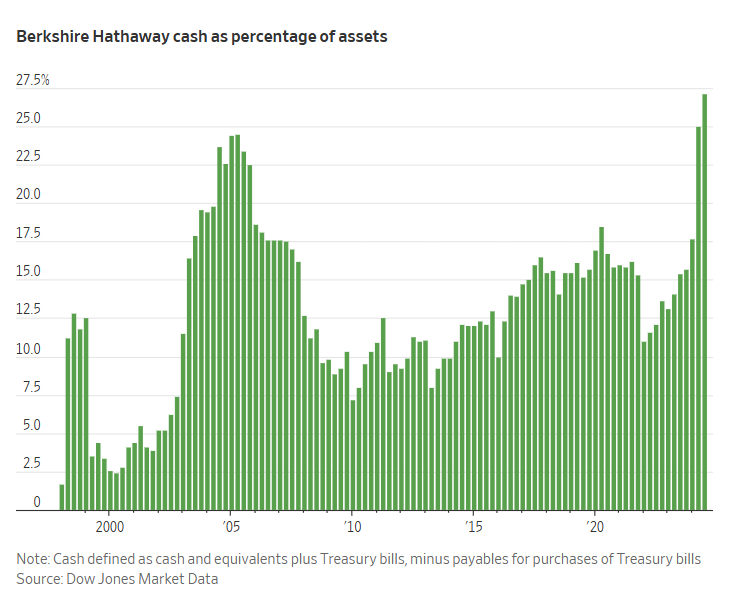

One thing to notice when it comes to Investment is the cash held by the legendary Warren Buffet in his firm Berkshire Hathaway, and the proportion have been piled up since the early 2020 to nearly 27.5%.