The advent of Trade War under Trump 2.0 and its initial effects

This post is served with the purpose of bringing some useful information about the global economy

1. Head and tail circumstances related to president Trump’s Tariff in the week

This week has been bustling surrounded by uncertainties related to tariffs and retaliations coming from several nations aiming to offset their potential loss against the US. Consequently, many assets have given the sense of turbulence and frustration to global investors and traders due to the back-and-forth vigorous utterances of included countries. Specifically, there are some striking news that are worth to notice and observe carefully to catch on in the upcoming months.

Trump fired a shot at Canada and Mexico with 25% tariffs, and China with 10% on multiple particular exported goods. Several days later, on Feb 2, PM of Canada, Trudeau, retaliated by imposing the same proportion on American products from beverages to appliances, worth C$155 billion ($107 billion). This raised confusions for everyone as how it occurred in such a fast pace, resulting in a drop of multiple assets such as Canada Dollar, S&P 500/Dow Jone/Nasdaq with a range up to 1%, Bitcoin back to below $95,000 with a significant outflow. After a few hours, Trump posted on his own social media “Truth Social” announcing that there would be pains, signaling more tariffs to come in incoming months.

Despite of the vigorous pronouncement on tariffs, after 2 phone calls with Mexico and Canada authorities on Monday, president Donald Trump and his allies have concurred with a halt on tariffs for 30 days, avoiding the escalation of trade wars and bringing the neighbours back from the verge of economic damages even globally.

Canadian Prime Minister Justin Trudeau agreed to reinforce his country's border with the US to clamp down on migration and the flow of the deadly drug fentanyl.

A deal with Mexican President Claudia Sheinbaum also came to fruition as the country will reinforce the northern border with troops. In return the US would limit the flow of guns into Mexico.

All of them considered this as a win due to the fact that both nations rely heavily on the US as far as the exportation is concerned. In fact, figures shows that it would be less damages for the US than the others when it comes to GDP ratio if the trade war comes to fruition.

As a results, Bitcoin has steepened from under $95,000 to the milestone of $100,000, giving individuals a roller coaster. US market appears to be relatively strong in spite of the negatives as investors are believed to ignoring market risks and still maintain high hopes on the future performance of US companies and economy.

This result sparkled a thought of Trump’s tariff strategy being all about negotiation. There are several proofs so far from Columbia, Mexico, and Canada that if nations are in line with the US, there is a chance that no trade conflictions will happen.

10% tariff on China goods has been in effect after the deadline. Shortly after, the announcement from Bejing related to retaliatory tariffs imposed on a raft of American products, including 15% on coal and liquefied natural gas and 10% on crude oil and agricultural machinery, is put forward.

The move is seen as a temporary reprieve, with the US president threatening to impose "very substantial" tariffs if no agreement is made with China.

In addition, multiple US companies located in China also suffered the retaliation of China government, notably Google with the Anti-Trust investigation.

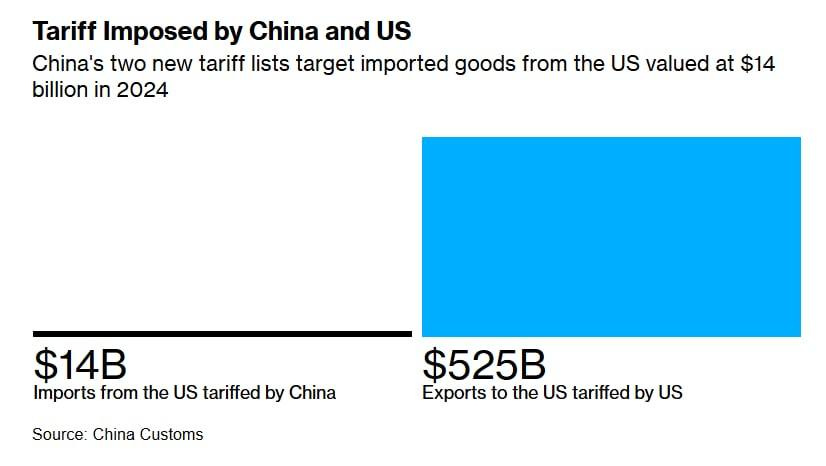

However, the effect of tariffs applied on America by China is estimated weaker than what the US imposes, around $15 billion compared to more than $500 billion of goods.

President Trump pledges to continue his plan on imposing tariffs to other nations next week, sparkling concerns related to Japan being in the target

2. The US job market is cooler-than-expected in December, dropping sharply to 7.6 million

Job openings declined significantly to 7.6 million, hitting the lowest level since September, while there was a slight uptick from Hiring. This result was in line with Fed’s expectation and might strengthen a more cautious move on rate cut hike for several upcoming meetings. Some experts have already made a forecast of interest rate remained by the Federal Reserve in this March.

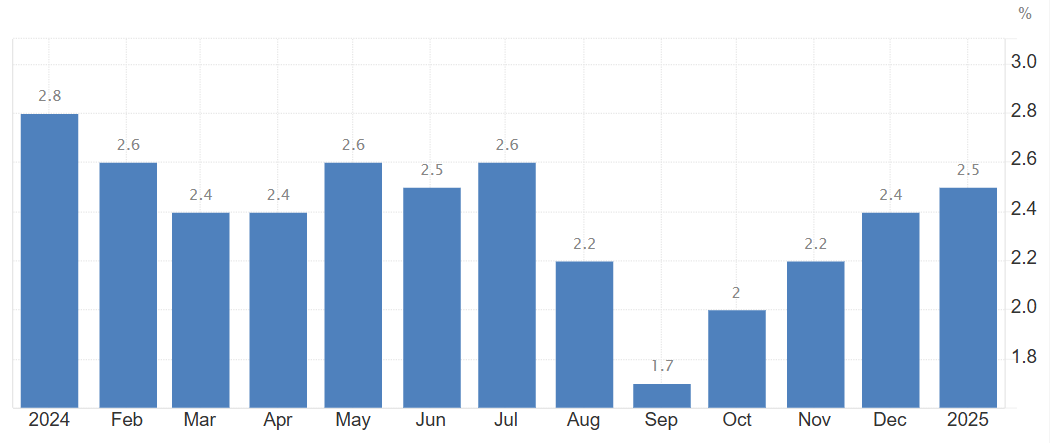

3. Hotter-than-expected inflation from Euro Zone as ominous trade war

The euro zone inflation rate accelerated to 2.5% in January, exceeding expectations, driven by a 1.8% jump in energy costs. Core inflation remained at 2.7%, while services inflation dipped to 3.9%. Economists predict inflation will reach the European Central Bank's 2% target by summer, with possible further rate cuts expected to support the economy.

4. Gold remained accelerated beyond a previous milestone of 2,800 as uncertainties of Trade War

5. Vietnam can be affected negatively if the Trump’s tariffs goes globally

The charts below illustrates trade dependency of nations with America, witnessing Vietnam being ranked first with the highest ratio. However, the consequence is believe to come in late as several considerations between president Trump and his allies, and the effect might not be “extremely negative” owing to the benefits of higher tariffs on China goods.