The downward trend in risk and growth assets (Weekly Summary)

This post is served with the purpose of bringing some useful information about the global economy

1. Miserable outlook for US stock markets and cryptocurrency amid upcoming tariff plans and, the strengthen and resilience of inflation

On Feb 25, crypto market experienced a bloody crash with over $150 billion liquidated, resulting in $325 billion loss since Friday. Bitcoin with a considerable drop to currently 86,857 but without any stalled signs followed by the range between 10% and 30% for other coins. The Fear & Greed Index is now 25, standing for Extreme Fear.

The largest weekly Bitcoin’s outflow also happened this week with nearly $3 billion.

The consequence is exacerbated due to a combination of factors such as low volatility in trading and investing, tariff concerns, and the potential uptick of inflation. At the same time, the performance of the US markets is not in a good position as well, especially tech sector struggling with the decrease of renowned names.

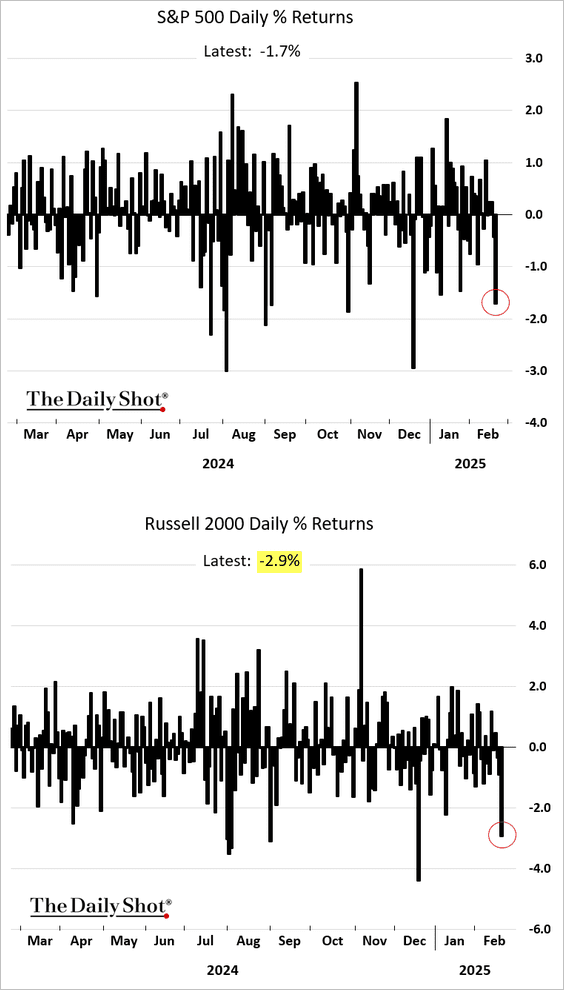

The sell-off spread not only in S&P500 but also in global market, with 2% downfall in Russell 2000 Index.

5% drop in Nasdaq 100 is witnessed this week, and it is near the oversold threshold in RSI Indicator.

2. The escalation of investors’ fear is constantly raising

On March 04, the official tariffs imposed on Canada and Mexico goods and an additional ones on China have taken action, and immediately, the retaliatory was announced by Canadian PM about applying the same amount of proportion on approximately $150 billion products from America, hence being retaliated by China as they try to offset the incoming loss. Consequently, according to CGM Kristina Hooper from Invesco:

US personal spending declined 0.2% in January, which was worse than expected.

Both retail sales and industrial production for January were lower than expected.

The flash S&P Global US Services Purchasing Managers’ Index (PMI) dropped into contraction territory in February at 49.7, down from 52.9 in January and well below expectations.

The new orders sub-index of the US ISM Manufacturing PMI Survey fell into contraction territory in February, from 55.1 to 48.6, experiencing the biggest drop since March 2022.

The Atlanta Fed GDPNow, which forecasts gross domestic product (GDP) growth in real time, has experienced a wild swing as of late, showing the first negative growth anticipation.

Inflation is expected to escalate in upcoming months due to the rise of prices and slow economic growth.

The halt in reducing FFR (Fed Fund Rate) is fully assured to exist in at least 1 more meeting owing to the fear of economic deterioration.

3. The US markets are reaching the strong support of MA200

As the index is approaching nearly to the 200-Day Moving Average, which has not been broken since 2024. This will be a powerful support for the US market as it might trigger a massive sell-off if the line is broken amid loads of uncertainties.

Nasdaq witnessed the same trend when the index has fallen into the MA200 support.

4. 10-year bond has recently skewed in most of the developed countries

Mikey Research is a place where I collect and rewrite the economic news. It helps me understand better the perspectives from all around the world and is the way to practice my writing skill, so it’s totally free. If you like my cozy spot, share it to your friend :)