Introduction

In 2023, the Year of the Rabbit is said to bring an energy that encourages balance and harmony. Rabbits are known for their cleverness and kindness, as well as their speed and charm. It is believed that these qualities will bring good fortune, such as money, partnerships, and success. The Rabbit is seen to possess a strong intuition, and is thought to be a harbinger of new beginnings, positive energy, and prosperity.

Those born in the Year of the Rabbit are said to be creative, confident, and compassionate, with a keen eye for detail and the ability to make decisions quickly. Rabbit Years are typically marked by peace and tranquility, and are considered to be a time of great luck, making them perfect for taking advantage of new opportunities.

In addition to the usual, January has also been an extraordinary month with a remarkable rise in the financial markets. To better understand this trend and how it is affecting the economy, we will take an in-depth look at some of the most influential trends that we have seen this month. These trends include the inflation, interest rate and employment statistics, also some valuable metrics for Macro and VNINDEX. With the help of this report, we can gain valuable insight into the market and better understand the overall direction of the economy.

1. Inflation

United State’s Inflation has been steadily decreasing over the past few months since its peak in June 2022 at 8.9%. The December Consumer Price Index (CPI) is currently at 6.4, a decrease of 2.5 in the past six months. The core CPI has also dropped, though not as impressively, to 5.6 (Dec), a difference of 1.0 from its top in September 2022.

Source: https://fred.stlouisfed.org/

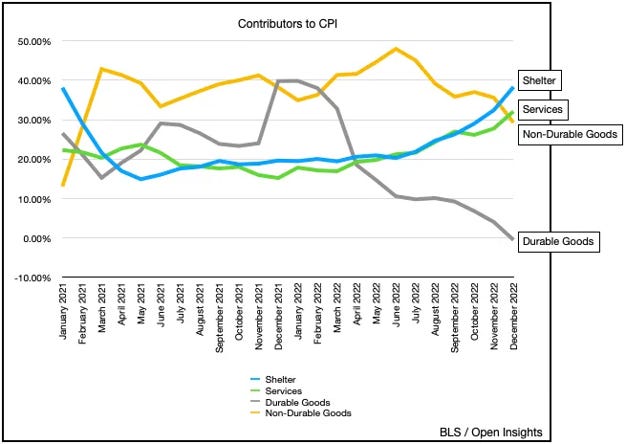

The sharp decrease in inflation can be attributed to a variety of factors, but the most notable one is the deceleration of prices for both nondurable goods, such as energy and food, and durable goods. This can be observed in the case of West Texas Intermediate (WTI) oil, which has seen its price remain relatively unchanged in the six months from June 2022 to December 2022, staying within a narrow range between $71 and $80 per barrel. This is indicative of an overall trend of a softening of prices throughout the market, which is one of the primary reasons for the decrease in inflation.

In contrast, services (~33% weighting) have seen a steady increase, while shelter (~38% weighting) has seen an even larger increase in recent months. The increasing need for services and shelter has meant that prices have been on the rise, making it increasingly challenging for those with limited financial resources to keep up. This trend has been particularly noticeable in the housing market, with shelter (~38% weighting) showing an even larger increase in price compared to services. These increases have been making it more and more difficult for those with limited means to afford these necessities, making it imperative that steps are taken to alleviate these financial pressures.

Vietnam's Consumer Price Index (CPI) has been steadily increasing since mid-2021, and the trend has continued into 2021. In January, the CPI stood at 4.89%, which is its highest level since 2020 and may be a sign of further price increases in the coming months. This increase in the CPI has been attributed to a variety of factors, including an increase in demand for goods and services, rising inflationary pressures, and the impact of the COVID-19 pandemic on the economy. The result of this is that citizens of Vietnam are facing a more expensive cost of living, with prices continuing to rise steadily in the months ahead.

2. Interest Rates

Yesterday, the Federal Reserve hiked interest rates from 4.5 to 4.75, a difference of 25 basis points, which was in line with expectations.

According to the Chair of the Federal Reserve, Jerome Powell, the Fed has sent a strong signal to the market that they are expecting an "ongoing increase" in the funds rate, while making it clear that they have "No incentive, desire to overtighten". This outlook is expected to bring the funds rate two more times before May 2022, when the Fed will then cease increasing the rate.

Vietnam's interest rate has remained steady and consistent at 6% since September 2022, providing an attractive environment for investors. This has been especially beneficial for small businesses, who have been able to take advantage of the low and stable rate to finance their operations. Additionally, the stability has allowed other investors to confidently plan for the future, secure in the knowledge that the central bank is committed to keeping the rate at 6%. This has been a major boon for the country's economy and has helped to create a secure and stable financial environment for all.

.

3. Employment

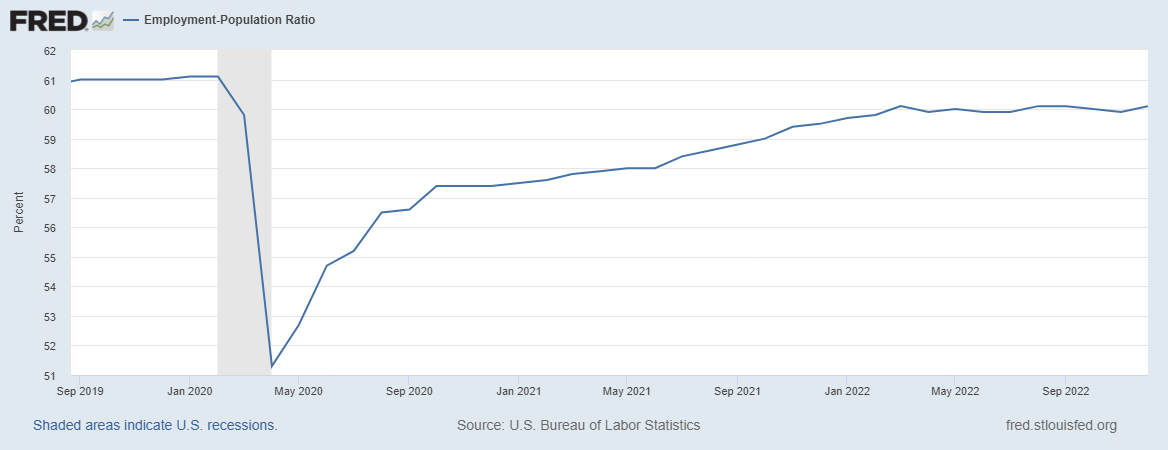

Employment has been steadily increasing since the start of the pandemic, but still remains below pre-pandemic levels. In February 2023, U.S. payrolls added 517,000 jobs, which is a great deal for the economy. Ironically, this could be sending a strong signal to the Federal Reserve to raise interest rates aggressively, which could have a negative impact on the market in the short term.

Currently, the employment-population ratio for the total population is at an impressive rate of 60.1%. This means that out of every 100 individuals, 60 are employed, making it one of the highest ratios seen in recent years. This is indicative of a strong labor market and a strong economy, as the employment-population ratio is an important indicator of economic health. It has been climbing in recent years, providing a positive outlook for the future of the labor market.

And the prime-age employment-population ratio (from 25 to 54 years old), a key indicator of job market health, is still hovering around its long-term ceiling of 80%, a plateau that has remained relatively consistent in recent years.

The unemployment rate in the United States remains low at 3.5%, a figure that has decreased steadily after the outbreak of the Covid-19 pandemic. This positive trend is a testament to the resilience of the US economy and the hard work of citizens across the country, who have adjusted to the new normal and adapted to the economic challenges posed by the health crisis. With the implementation of stimulus packages, tax cuts and other measures to support businesses, the unemployment rate has continued to decline.

Vietnam's total population is estimated at 99.5 million, with a staggering 50.6 million of those aged 15 and above employed. This gives a ratio of employment to population of approximately 50%. With the country's economy rapidly expanding and its population continuing to grow, it is essential that the Vietnamese government continues to focus on creating jobs and providing employment opportunities to its citizens. This will ensure that the country maintains a healthy employment rate and that the positive trend in job creation continues.

Source: https://www.gso.gov.vn/en/data-and-statistics/2022/12/infographic-social-economic-situation-4th-quarter-and-2022/

4. VNINDEX

The VNINDEX experienced a strong recovery in January 2021, rising from 1007.09 to 1111.18 points, a 104.09-point increase or 10.34%.

Fundamentally, the macroeconomy is still in a bad shape. US CPI has decreased, but not entirely. Services are still on an uptrend in terms of price, which could be a potential risk with the Fed's uncertainty of pivoting. The interest rate is set to stop, which is a dovish news, but it is important to remember that the rate will stop, but it might remain for a while before the Fed pivots, and the high rate could have a significant impact on the middle class.

Vietnam has a relationship with the United States, so it cannot escape unscathed. Two things to consider are the Consumer Price Index (CPI) and Interbank Rate, which could pose a potential risk in the coming months. The CPI measures the cost of goods and services, whereas the Interbank Rate is the rate at which banks lend to each other. A rise in either of these two indicators could have a noticeable impact on Vietnam's economy generally.

Technically, VNINDEX weekly chart is extremely ugly.

The latest candle has ejected the EMA 34, which has been under the EMA 89 for a prolonged period of time, and continues to decrease further, following the Primary Trend. This indicates a lack of bullish momentum and an increasingly bearish outlook on the market. This downward trend is concerning as the index may continue to drop further before any signs of recovery are seen.

MACD will appear divergence (which really bad and can cause a drop) if the trend in the future go sideway or down.

Observe carefully the strong resistance at approximately 1000. It is important to stay vigilant and assess any potential market developments in order to effectively evaluate the situation and make informed decisions regarding investments.

5. Conclusion

It is important to consider the longer-term macroeconomic trends when evaluating the current state of the economy. Over the next few months, it will be interesting to observe how the various trends discussed here evolve and affect the overall economic outlook.

Key points to remember in the report:

The actions of the Federal Reserve will be key in determining the future direction of the economy.

The macroeconomy is still in a bad shape, with US CPI decreasing but services still on an uptrend.

The Fed's interest rate is set to stop, but it could remain for a while before the Fed pivots, potentially having a significant impact on the middle class.

Two things to consider are the Consumer Price Index (CPI) and Interbank Rate, which could pose a potential risk in the coming months.

Personal Information:

Facebook: https://www.facebook.com/kienquoc03/

Linkedin: https://www.linkedin.com/in/quoc-nguyen-1131aa19a/