Weekly Macroeconomy News (Dec 02 - 08)

This post is served as supporting information about the global and domestic Economy.

Inflows of Bitcoin and Ether’s ETF witness massive recorded volume in November since Trump’s Embrace of Crypto.

Crypto market has been up over $1 trillion since Trump’s election win as traders expect US regulators to pivot to a friendlier stance. The Ether/Bitcoin ETFs from multiple institutions such as BlackRock Inc., Fidelity Investments’ Ethereum Fund, and Grayscale Investments LLC, which are the largest issuers of digital-asset portfolios by fund size, shows the vast inflows to the funds from investors, combined at over 300 millions of Dollars.

According to the trading platform’s founder Nick Forster, in the options market, about 77% of Ether open interest on Derive.xyz comprises bullish wagers, versus 66% for Bitcoin, revealing the crowd bullish expectations on the cryptocurrency sector.

The XRP token extended a parabolic surge on expectations that Trump will undo a Securities & Exchange Commission crackdown that had weighed on the fourth-largest digital asset. Some investment firms are seeking to start XRP ETFs, given information by Bloomberg.com

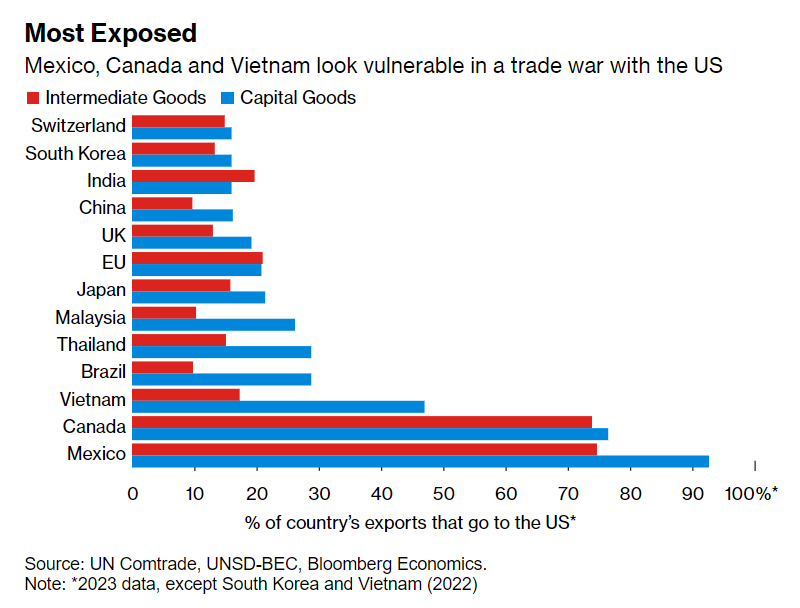

Vietnam, Mexico, and Canada potential risks breaking down on exporting to the US

Top 3 countries exporting heavily to the US remain Mexico, Canada, and Vietnam. Capital goods account for its highest proportion of the US’ import in Mexico with more than 90%, approximately 75% and nearly 50% respectively in Canada and Vietnam. Moreover, Vietnam exports the least amount of intermediate goods among the top 3 with nearly 20%, while Canada and Mexico both almost have the same proportion of the goods exported to the US, at approximately 75%.

Capital goods: physical assets a company uses to produce goods and services for consumers including Tools, Machinery, Vehicles, Computers, and Construction equipment

Intermediate goods: products that are used in the production process to make other goods including Glass, Wheat, Steel, Wood, Precious metals, Paint, Hardware

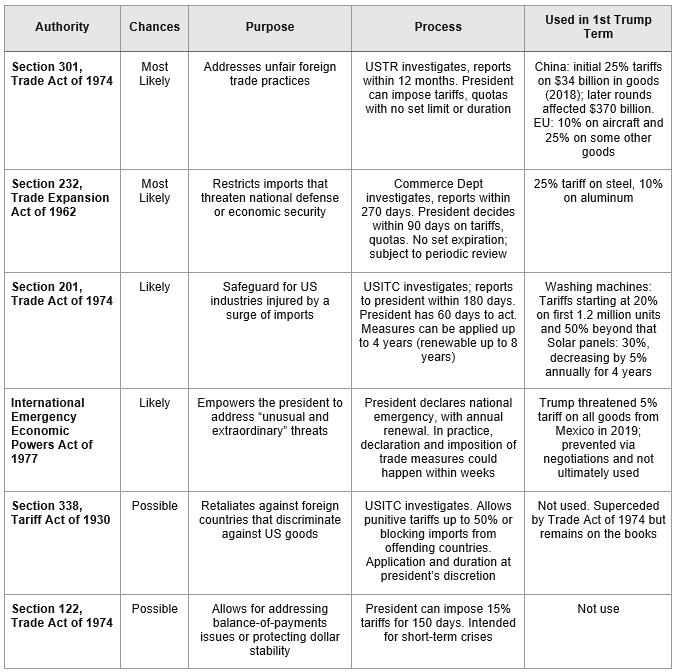

Trump’s Trade Toolkit, according to Bloomberg

Won Currency recovered after hitting its lowest price since 2022 compared with the Dollar due to short-period Material Law announcement

Korean current president, Yoon Suk-Yeol, adduced the Material Law, which happened for the first time since South Korea achieved full democracy nearly 40 years ago, creating chaos in domestic and global political views. His announcement and withdraw occurred quickly in just a few hours, raising concerns from international peers, especially the US. Here are the Timeline of Martial Law in South Korea (all times local and approximate)

Yoon declares martial law in address on national TV (10:35 p.m. Tuesday)

Head of ruling party states opposition to martial law decree (10:50)

Opposition leader says martial law ‘illegal’ and invalid (11:14)

Yoon appoints martial law commander, Yonhap reports (11:29)

Martial law forces attempt to enter parliament, Yonhap says (12:10 a.m. Wednesday)

Parliament convenes (12:50)

Parliament unanimously passes request to lift martial law (1:00)

Martial law forces leave parliament (1:15)

Bank of Korea monetary policy board says to convene meeting (1:32)

Largest umbrella labor group says to hold general strike (3:10)

US Defense Secretary Lloyd Austin says ‘closely monitoring’ situation (4:05 a.m.)

Yoon says on TV that he will lift martial law (4:29)

Cabinet approves lifting martial law (5:20)

With the rise of uncertainty, the Won immediately dropped and has recovered after the Material Law is drawn out.

Bitcoin Historical Milestone: 100,000$

Bitcoin have just touched the sky of 100,000$ milestone with incredible volatility. This might be due to Donald Trump’s new announcement about appointing former PayPal Chief Operating Officer David Sacks as his "White House A.I. & Crypto Czar", generating overhype among all the crypto community.

New-elected president confirmed in a post on his social-media site Truth Social: “He will work on a legal framework so the Crypto industry has the clarity it has been asking for, and can thrive in the U.S.,"

In addition, a vast liquidation was added to Bitcoin at the time it climbed to the historical milestone.

Is the current US stock market expensive?

S&P500 forward P/E, the powerful indicator exposing the valuation of made-in-America stock, are on its road to once again reach the 2022 peak of over 23, showing investors’ strong belief in a resilient improvement of the economy while being tightened by monetary policy from the Fed. However, we also witnessed one of the largest amount of cash held by Warren Buffet as he and his team in Berkshire Hathaway might anticipate that the market is currently overrated and too expensive?

Nevertheless, in Ed Yardeni & Eric Wallerstein perspectives, they think that the key driver of the forward P/E is investors’ perception of how much and for how long earnings can grow before the next recession depresses earnings and the valuation multiple. Economic growth drives earnings growth, and investors’ expectations for both drive the forward P/E.

This can be understood as the expectations of investors for US stocks are extremely elevated, which can result in both sides of the face. The chart below illustrates the current bullish momentum compared with other 8 increased periods.

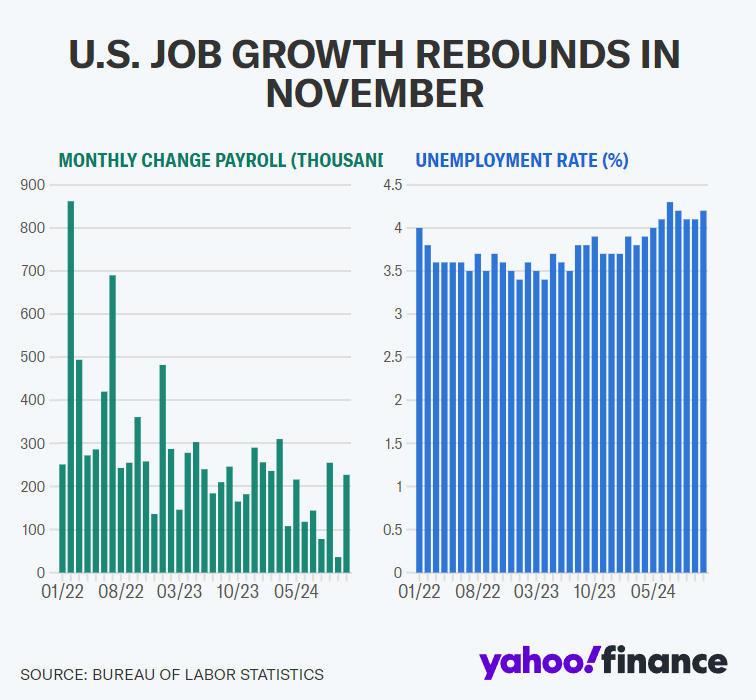

227,000 jobs were added to the US economy while labor market witnessed rebounds as unemployment rate rose to 4.2% in November.

With the given statistics, the expectation of 0.25% interest rate cut from the Federal Reserve is rising widely, with markets have already priced in a nearly 87% chance the Fed cuts rates in December, up from a 66% chance seen a week ago, per the CME FedWatch Tool.