Weekly Macroeconomy News (Dec 09 - 15)

This post is served as supporting information about the global and domestic Economy

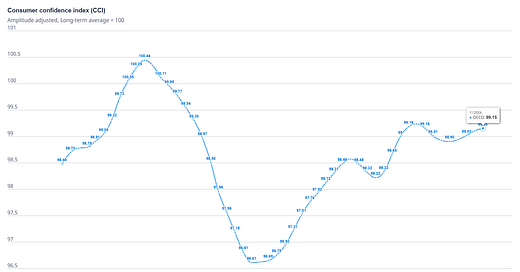

US Consumer Spending Is Recovering

The consumer confidence index appears to climbing back to its peak in January with 99.15, revealing the positive thoughts of households towards the future economic situation.

There are various companies also commenting about the uptick of consumer spending currently, according to The Transcript:

"I would say the U.S. consumer economy, we obviously have just gotten through Black Friday and Cyber Monday, consumer confidence is relatively high." - Microsoft (MSFT 0.19%↑) EVP & Chief Commercial Officer Judson B. Althoff

“Obviously, we help that lower-end consumer, and I hear what you're saying. Certainly, they have spoken and they want the help. And I think they're -- from a consumer confidence index standpoint, they're maybe feeling a little bit more confident about the future, hopeful” - America’s CarMart (CRMT 1.38%↑) President Douglas Campbell

“...you're already seeing some of the upticks on surveys with industrial PMI moving higher. Consumer confidence sitting at 7-month highs. Consumer confidence for durable goods at 4-month highs. So I definitely agree with you that there is a sense of optimism,” - RXO (RXO -0.12%↓) CEO Drew Wilkerson

"...we continue to see healthy consumer spending. So spending remains strong or healthy. At the end of the day, there's positive and negatives across the macro. But as I said, it's -- there are supportive and stable backdrop for the consumer itself." - Mastercard (MA 0.26%↑) EVP of Investor Relations Devin Corr

"...overall drivers are looking pretty healthy. As we sort of click into the holidays, now we have sort of the Thanksgiving weekend, so Thursday through Sunday...several points ahead of where we saw a year ago in terms of growth." - Visa (V 0.23%↑) CFO Chris Suh

Pros and Cons in Trump’s new policies, according to Kristina Hooper

The debate about the advantages and disadvantages of new policies from president-elect Donald Trump has been discussed vibrantly lately. Indeed, Kristina Hooper from Invesco has posted a really interesting perspective about this topic. In her opinion, there will be 2 positive factors and 2 negative ones for the upcoming economy

A. Potential growth opportunities: Deregulation and tax cuts

Deregulation: The Trump administration’s goal of removing 10 regulatory rules for each new regulatory rule is likely to create an environment of hyper deregulation. This is likely to be positive for economic growth since businesses are more likely to invest when the political environment favors deregulation.

Timing: Traditional Deregulation can be implemented immediately because of the unnecessity of Congress approval requirement, while the the reversal of major regulations and elimination of entire government agencies would take more time.

Market impact: This is likely to encourage a ‘risk on’ environment for investing in general. Financial stocks and cryptocurrencies could especially benefit.

Tax Cut

The administration plans to extend the Tax Cuts and Jobs Act (TCJA), which could positively impact economic growth. Tax cuts have varying effects based on income levels:

Lower/middle-income tax cuts: multiplier effect of 0.3-1.5

Higher-income tax cuts: lower multiplier effect of 0.1-0.6

There's a proposal to reduce corporate tax rates from 21% to 15% for domestic manufacturers, though this may be challenging to implement due to budget constraints and defense spending needs. Key concerns include:

The original TCJA increased fiscal deficit and government debt.

According to Brookings Institution, unfunded tax cuts could reduce long term growth through increased federal borrowing.

However, Trump's advisers argue that lower taxes will stimulate economic growth and eventually self-fund.

B. Potential growth challenges: Tariffs and immigration restrictions

Tariff: President-elect Trump has promised to increase tariffs on Chinese goods to 60% or more and to implement a universal baseline tariff of 10% on goods from other countries.

Market impact:

Tariffs applied during the first Trump administration led to stock market volatility and a negative return for the S&P 500 Index in 2018, although it didn’t have a material impact over the longer term.

Chinese stocks were even more negatively impacted, posting double-digit losses in 2018, but were not affected over the longer term.

The tariff wars also led to a flight to quality globally, with the US dollar strengthening by 4.3% over the course of 2018.

Restrictive immigration policy. The incoming Trump administration’s articulated immigration policy has two key components: securing and essentially closing the US’ southern border, and deporting undocumented people already living in the United States.

Market impact:

Mass deportations could prove very negative for economic growth — and they could also be inflationary, given that the US labor market is already very tight, with current unemployment at 4.2%

If deportations were to drive up inflation and in turn stall (or worse, reverse) Fed easing, that would likely reduce stock market returns.

If deportation were to negatively impact growth and create a stagflationary environment, that would likely result in a significant stock market downturn.

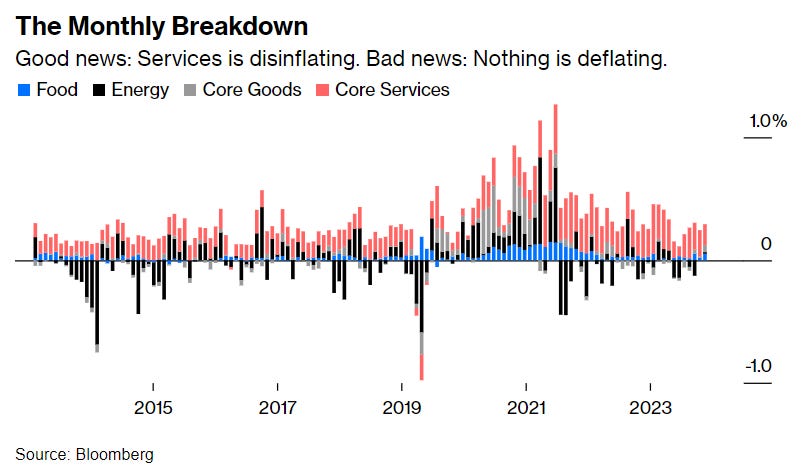

Inflation rose in line with Forecast, boosting the expectation of Fed Rate Cut

CPI report released on Wednesday showed the figures of inflation in line with policymakers forecast, with core consumer inflation, which excludes volatile food and energy costs, increased by 0.3% for the four consecutive month.

Shelter costs cooled from the previous month, while goods prices excluding food and energy, an area where costs had been falling, rose 0.3%, the most since May 2023.

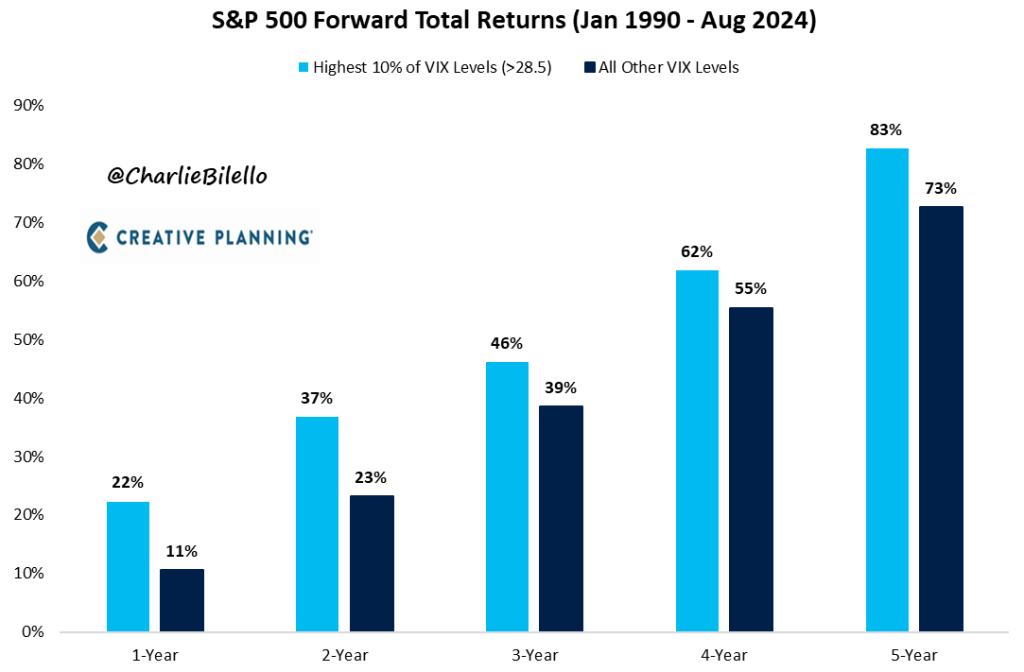

The reveal has hyped people’s belief in a quarter cut of the Fed Fund Rate next week. Thus, the incentives spread globally with the rise of S&P 500, 20,000 milestone for Nasdaq Composite, Asia Stock Index, and also Bitcoin (cryptocurrency).

However, the ease of this year will result more uncertainty about where the economy land next year with many potential risks.

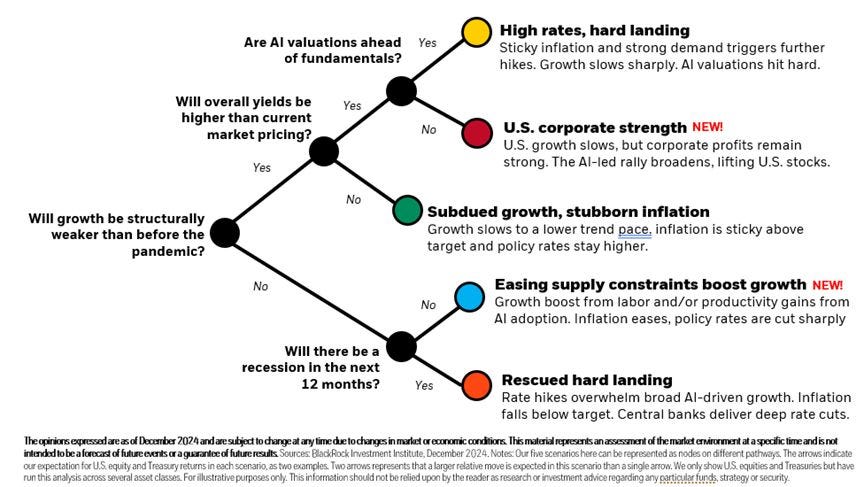

Several Key Trends for 2025

Will Trump’s policies push up or bring down the domestic and global economies?

What will happen with China?

Will Geopolitics be more intense and how will it affect the global trade?

Will AI bubbles be more bigger or explode?

Will the US Dollar strengthen and rise dramatically and how will it affect other markets?

Below is an interesting framework of Blackrock showing the global economy in 2025

The annual stock prediction from renowned financial institutions might not work precisely anymore

The S&P500 has risen 25% above the target price, reaching 6,090. This figure is more far beyond any expectations, even the most bullish price of 5,400 from Yardeni Research.