Weekly Macroeconomy News (Dec 16 - 22)

This post is served purposely for useful information about the global economy.

Four themes to notice for the incoming 2025, according to Kristina Hooper

As we are about to enter one of the most potentially growing year, yet align with the great amount of uncertainty, it is worth to acknowledge some key points that might affect to the world:

Theme 1: Fiscal conservatism

I believe fiscal conservatism will matter more in 2025. We’ve seen multiple recent examples of global markets being concerned about rising fiscal deficits:

There are several international markets affected by the uptick of fiscal deficits such as France and Germany not passed the 2025 budgets causing disappointments, Korea announcing Material Law due to a budget battle with the opposition party, and Brazil’s lack of structural reforms and spending cuts leading to the rise in Debt-GDP ratio.

Consequently, more budget battles will be witnessed in 2025, including in the largest economy, the US, where the threat of bond vigilantism looms large and where policymakers of both parties are attempting to pursue their respective agendas while also reducing budget deficits.

Theme 2: Monetary and fiscal policy

Two important factors driving the economy next year would likely to be Monetary and Fiscal. Several attempts in improving the markets through monetary strategies have been made by nations around the word including

Bank of Canada (BOC) with a decision to cut rates by 50 basis points

Central Bank of Brazil hiking rates by 100 basis points last week in order to stabilize the real.

Swiss National Bank (SNB) with a larger-than-expected interest rate cut of 50 basis points last week.

European Central Bank (ECB) lowering its key policy rate by 25 basis points last week.

Theme 3: Geopolitical risks

Geopolitical risks are likely to increase in 2025, especially when the new government of the US take the jobs next year.

This will likely affect the strength of the US Dollars, Gold, and Cryptocurrency.

Theme 4: Technological innovation

Artificial Intelligence (AI) has so far made a great impact and undeniable applications among multiple industries in 2024, making the jobs more efficient and productive. As a consequent, it is inevitable for Technology to continuously grow in 2025 when nations are currently having the urge to apply and develop their own AI to so as to catch up in the Technology Era.

Fed Chair Jerome Powell has just stolen our Christmas

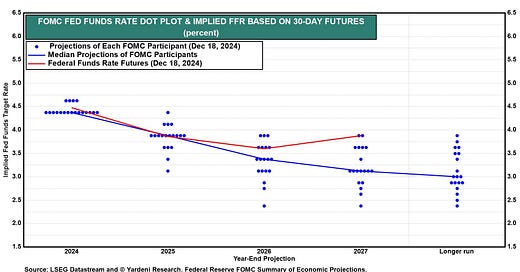

A quarter cut in Fed Fund Rate (FFR) was announced on Wednesday by The Federal Open Market Committee (FOMC), dropping from 4.5% to 4.25%, as widely anticipated. However, that is not only the main point that people focus on, the Plot Dot is also what markets want to pay attention to. The median plot dot for the upcoming year lies under 3.75%, signaling the fewer rate cuts next year due to the strong performance of the US economy in 2024 and in order to combat with the sticky inflation.

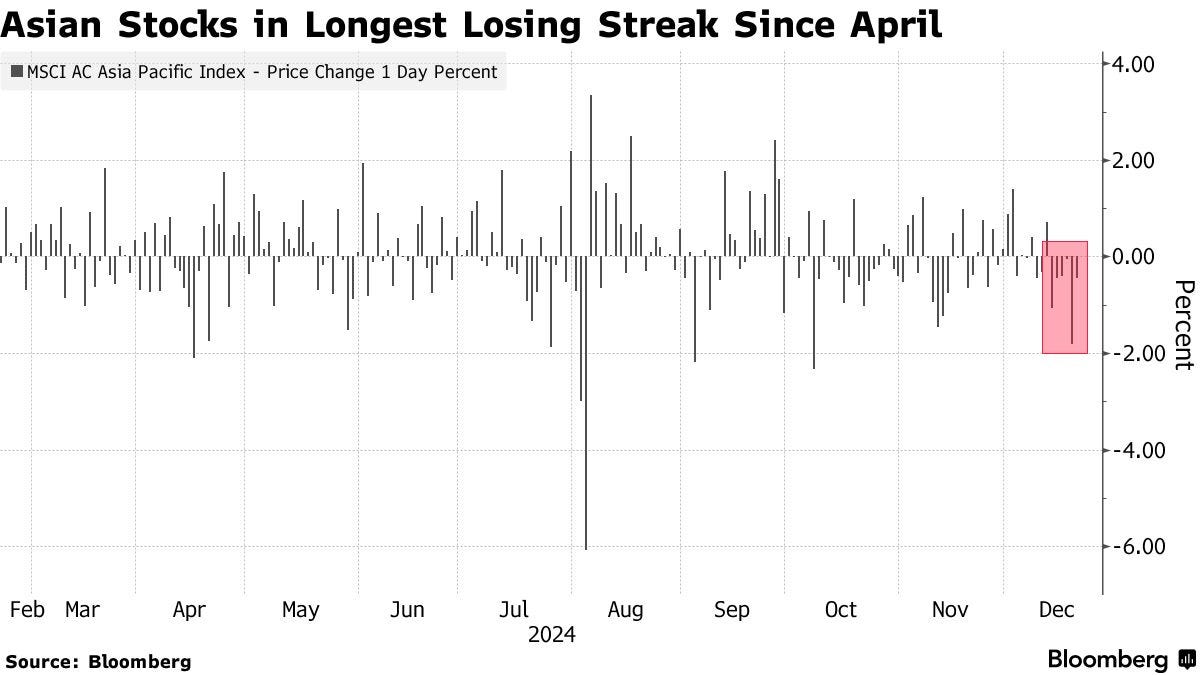

Consequently, the markets reacted negatively to the news with the S&P 500 fell almost 3%, the Nasdaq dropped 3.5%, Bitcoin tested $100,000 milestone, while the 10-year yield rose to 4.51%, its highest since May, and the VIX index was up to 28. As far as the overall economy is concerned, some experts commented that the markets might be overreacted with the news since it showed the positivity, reflecting investors’ fragile sentiment toward the related reports.

The South Korean Won continues to show weakness against the US Dollar as it has reached the lowest level since the Global Financial Crisis

A solid run from Mag 7 in 2024 compared to other indexes

Magnificent 7 has had a significant uptick since the beginning of the year compared to the whole index S&P 500. Despite of the bullish, some experts remain positively with another upward trend for the Info Tech in 2025 due to deregulations, AI developments and wide applications.